Community as Capital:

Why We Invest in People-Building

The easiest way to think about Founders Circle Capital is as a growth stage investor. And we certainly invest in companies; we actually just raised $355 million for our third fund to do just that. But investing capital absolutely does not make us who we are.

Our defining investments are in the professional and leadership development of the people who build companies—powered by a private community we call The Circle—and in giving those people the opportunity to keep building for as long as they possibly can.

Over the years, we haven’t sought much of the spotlight. We’re honestly not the best at talking about ourselves. But with the arrival of Fund III, we feel it’s finally time to take a minute to explain how we work differently, and more importantly, why we work that way.

FUND III AND FLEXIBLE CAPITAL

Let’s do the investing side first, where—as you may have guessed—our approach is something of a divergence from the norm.

In eight years, Founders Circle has raised three funds totaling nearly $1B under management. To date, we’ve invested in 73 companies, 12 of which are now publicly listed. 19 more were acquired by strategics. Zero have shut down.

We Invest in People | Since 2012

We began as a firm focused on employee liquidity (aka, secondaries) for the fastest growing venture-backed companies after observing how an ever-growing abundance of capital extended the average company’s private life from 5-7 years to 10-14 before it entered into its public one. This dynamic cranked up the pressure valve on countless employees whose startup salaries no longer covered their bills while their wealth-creation moments drifted further and further away. All the while, we saw companies struggle to fend off the recruiting battalions as Facebook, Apple, Amazon, Netflix, and Google took a “poach-to-grow” approach.

It was a problem that demanded a solution, and so our focus in Funds I & II was the delivery of personal capital to executives and employees when they needed it most, encouraging them to go long on their companies. We even drew up the roadmap for how to execute that form of investing in an above-the-board manner by creating the available-to-all Definitive Guide to Employee Liquidity.

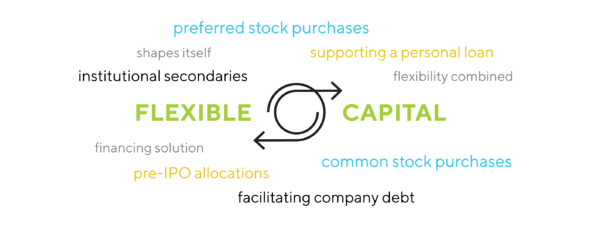

For Fund III, we’re evolving our investment approach to something we call “flexible capital”.

Flexible capital is a financing solution that shapes itself around what you need whenever your business or employees need it. We don’t ask you to fit into our structure or some prescribed check size. Flexible capital can mean shoring up the personal balance sheet of a team member via a common stock purchase or supporting a personal loan. Or institutional secondaries via preferred stock purchases from early financial backers. Or the company balance sheet via preferred stock purchases, facilitating company debt, or pre-IPO allocations. All of these occur individually or can be flexibly combined, however you wish, as you may need at that moment in time.

That flexibility powers another aspect of the people-building we believe in so deeply: allowing employees to stay on for years to come via secondaries, while also providing the primary capital required to bring in the next wave of difference-makers, who themselves will be built into something extraordinary. Flexible capital is an investment in the strength and longevity of your company’s own internal community.

We are extremely excited about the new fund. Monumentally excited. But beyond the somewhat straightforward investing side of things, Fund III also gives us the opportunity to grow the part of Founders Circle that we consider to be the reason we exist.

THE CIRCLE: A TRUE COMMUNITY OF CEOs and CFOs

At Founders Circle, we’ve managed to assemble a rare team of people-builders who are deeply committed to the success of others. People whose purpose is centered around the belief that if we give well—and authentically—opportunities will never be in shortage. “Give to get” is how we speak about it internally. So from the moment we launched Founders Circle, we began creating something called The Circle, a private leadership community for CEOs and CFOs of the fastest-growing companies — not just those we invested in.

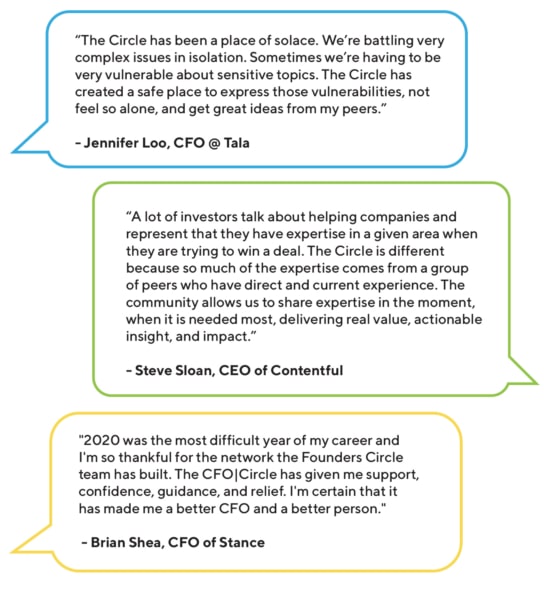

While the word “community” is at constant risk of devolving into a marketing cliche or a synonym for “one pretty nice dinner with people you’ll never see again,” true communities hold immense power. The Circle community is constant. Within it, no question is too small to ask, no dilemma too massive to collectively solve. And the true beauty of The Circle is that every bit of the collective problem solving is driven by its members. This is their community, not ours.

Circle members gather with intention and purpose, both online and in person. We wake up daily to find a litany of questions in our inboxes met with insightful answers from peers intent on helping one another. Need to determine the required people, processes, and systems to be prepared for your IPO in six quarters? Or to augment your BOD while improving how you lead them through key business decisions? Grappling with the difficult reality of your company outgrowing a key early executive’s skillset and struggling with how to make the right change? Expect a torrent of answers from Circle members, all eager to reveal scar tissue and share actionable stories of their own triumphs (or defeats).

These executives have created a safe place to assist each other. To allow for a little messiness. To bravely say out loud, “I don’t know” or “How do I?” or “I’ve really screwed this one up and I need to fix it!”. Vulnerability—that’s the secret ingredient. When ego releases its grip, actual listening and learning begin, and you realize you’re far from alone in this most ambitious and treacherous startup journey.

So much of investing is focused on growth, growth, growth—but we believe that company growth is impossible without first empowering executives in their personal growth. And perhaps the most remarkable aspect of The Circle is that surface-level operational problem solving actually drives something far more impactful: with every challenge overcome, you build conviction in yourself. A conviction that allows you to turn to anyone you work with or for and skillfully guide them on the subject at hand—the conviction to lead.

HOW FUND III AND THE CIRCLE POWER EACH OTHER

The Circle is not some value-added service appended to our investment activities or flowery words on a website that sound better than what’s actually delivered. The entirety of our firm is organized around delivering on this people-building service first and foremost.

Now here’s the part you almost definitely didn’t expect: 86% of Circle members are outside our portfolio. Since the beginning of 2020 alone, 436 unique growth stage executives leading 264 growth stage companies have convened for 60+ executive sessions.

We Invest in You | A true community of CEOs and CFOs

Do we sometimes invest in companies whose executives are Circle members? Absolutely. But long before that, our goal is to be the most useful investor they know, even if we aren’t their investor. To us, investment is a privilege, and we see but one way to earn it: to build authentic relationships and deliver material value long before we write a single check. In the meantime, we work tirelessly so growth stage executives view The Circle as their day-to-day, minute-to-minute, go-to resource.

We believe, to our core, in the organizing principle of community as capital and that no company can be built if its people aren’t built first. Though funding in its various forms is essential, an investment in you is the most valuable currency we can offer.